How do you want to get started?

Quick application

With Millennial Home Loans quick online loan application, determining if you qualify for a Purchase Plus Program Loan and for how much, has never been easier.

Talk to a Purchase Plus Program Mortgage Expert

Not ready to apply online? No problem. Answer a few questions, and a Purchase Plus Program Home Loan Mortgage Expert will call you back.

Home » Down Payment Assistance Programs - Purchase Plus » Guidelines

Purchase Plus $5,250 Down Payment Credit – Special Limited Time Only

The Purchase Plus Down Payment Assistance Credit Is Based On First-Time Homebuyers Current Residence And Not The Location of Where They Will Purchase

Purchase Plus Loan Program Guidelines

Current Household Residence

The borrower must CURRENTLY live in a designated area, which can be determined using the below Purchase Plus address verification tool

Loan Purpose

- Purchase

Credit Profile

- 620 minimum middle credit score for all borrowers on the loan

- Desktop Underwriting findings must be “Approved/Eligible”

- Waiting period after a major negative credit event

| Conventional Loan Type | BK – Chapter 7 | BK – Chapter 13 Discharged | BK – Chapter 13 Dismissal | Foreclosure* | Short Sale, Deed-In-Lieu, Pre-Foreclosure* | Modified Mortgage* |

|---|---|---|---|---|---|---|

| Standard | 4 years | 2 years | 4 years | 7 years | 4 years | 2 years |

| With Extenuating Circumstance | 2 years | 2 years | 5 years | 3 years (requires 10% down) | 2 years | No waiting period |

* If a property was included AND surrendered (i.e. property wasn’t retained and the debt wasn’t reaffirmed) in a Chapter 7 Bankruptcy, the borrower may potentially be able to defer to the Chapter 7 waiting period Vs. the Foreclosure waiting period.

Current Household Residence

- The borrower must live in a designated, which can be determined as follows:

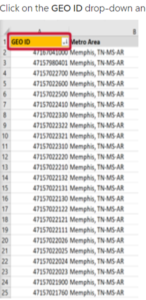

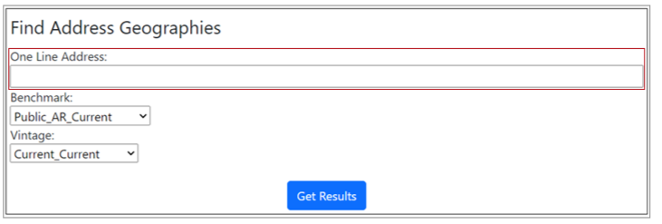

1. Access U.S. Government geocoding lookup tool by Clicking Here

2. Input the current primary address into the “One Line Address:” field and click the “Get Results” button

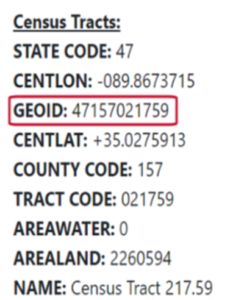

3. Once the results load, scroll down to the bottom of the page to the “Census Tracts” section. Note the GEOID, which can be 10 or 11 digits

4. Open the Census Tract Lookup file for:

- Baltimore/Columbia/Towson Click Here

- Philadelphia Click Here

6. If the GEO ID is on the Census Tract Lookup file, the homebuyer is living in an eligible cense tract for Purchase Plus

Income Restrictions

- There are no Area Median Income restrictions on this loan program

Loan Amount

- Conforming loan limits

- High balance loans are eligible, however will require a 5% down payment or 95% loan-to-value

Mortgage Insurance

- Reduced mortgage insurance pricing

Ratios

- As determined by Automated Underwriting System. Requires a Desktop Underwriting findings must be “Approved/Eligible”

Property Type

- Owner-occupied only

- Single Family Residence

- Fannie Mae approved condos

- PUD’s (i.e. Townhomes)

- Manufactured homes

- Log cabin homes provided Appraisal Report lists other comparable log cabin homes that have recently sold in the area

Documentation

- All loans must be fully documented per Agency Guidelines

- For Self Employed borrowers, in addition to Agency Guidelines, two years of the tax returns (personal and business) along with a year-to-date profit and loss (unaudited)

- A First-Time homebuyer class is required

Down Payment/Closing Costs – Purchase

- Down payment minimum requirements:

- 1 unit primary residence – 3% down payment

- No minimum borrower contribution required

- 1 unit residence – minimum 5% down payment:

- With non-occupying co-borrower

- High balance loan

- 2 – 4 unit primary residence

- 2 unit – 85% loan-to-value

- 3 to 4 unit – 75% loan-to-value

- Borrower contribution:

- 80% loan-to-value no minimum borrower contribution required

- Greater than 80% loan-to-value requires a 3% minimum borrower contribution

- 1 unit primary residence – 3% down payment

- Maximum seller contribution toward buyers closing costs and escrows up to:

- 3% of the purchase price based on 90% loan-to-value and higher

- 6% of the purchase price based on 80% to 89.99% loan-to-value

- 10% of the purchase price based on max 79.99% loan-to-value

Terms

- Amortization period: 30-year fixed rate

Rental Income

- Rental income from an Accessory Unit on a subject 1-unit primary residence is eligible income

- Boarder Income requirements must be met to use the income. Boarder income is eligible with all of the following:

- Boarder has been living with the client in the client’s primary residence for the most recent 12 months

- Evidence with 12 months canceled checks or bank statements

- Boarder can show proof of shared residency

- Example: Driver’s license

- Up to 30% of a client’s qualifying income can come from boarder income

- Boarder is not obligated on the mortgage or has ownership interest in the property

- Boarder income is from a 1 unit property

- Income must be averaged over the amount shown on the 12 months canceled checks or bank statements