How do you want to get started?

Quick application

With Millennial Home Loans quick online loan application, determining if you qualify for a Purchase Plus Program Loan and for how much, has never been easier.

Talk to a Purchase Plus Program Mortgage Expert

Not ready to apply online? No problem. Answer a few questions, and a Purchase Plus Program Home Loan Mortgage Expert will call you back.

Purchase Plus $5,250 Down Payment Credit – Special Limited Time Only

The Purchase Plus Down Payment Assistance Credit Is Based On First-Time Homebuyers Current Residence And Not The Location of Where They Will Purchase

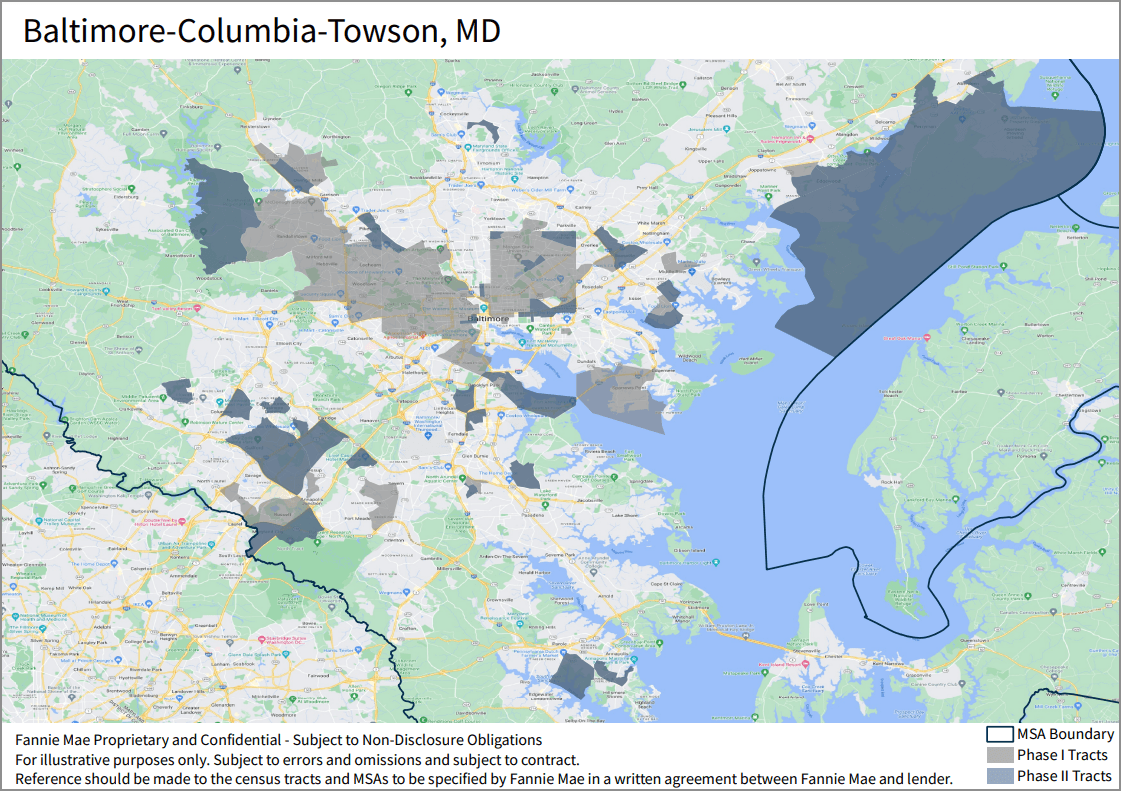

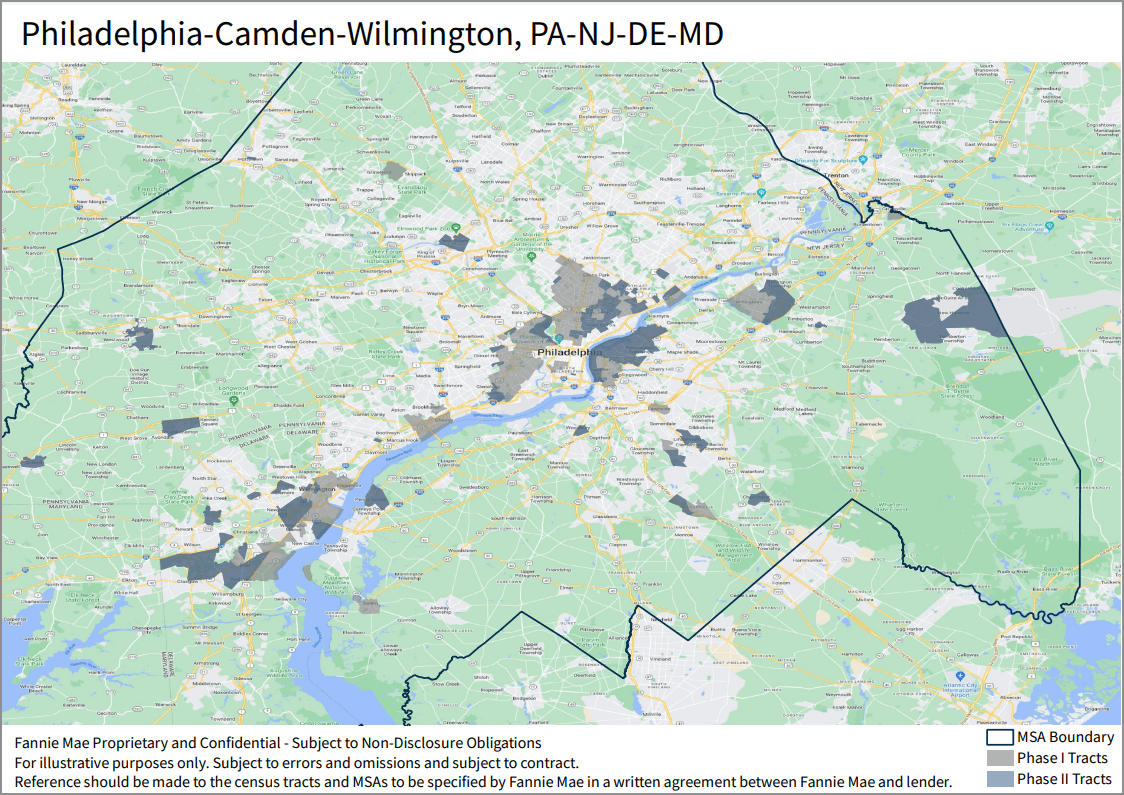

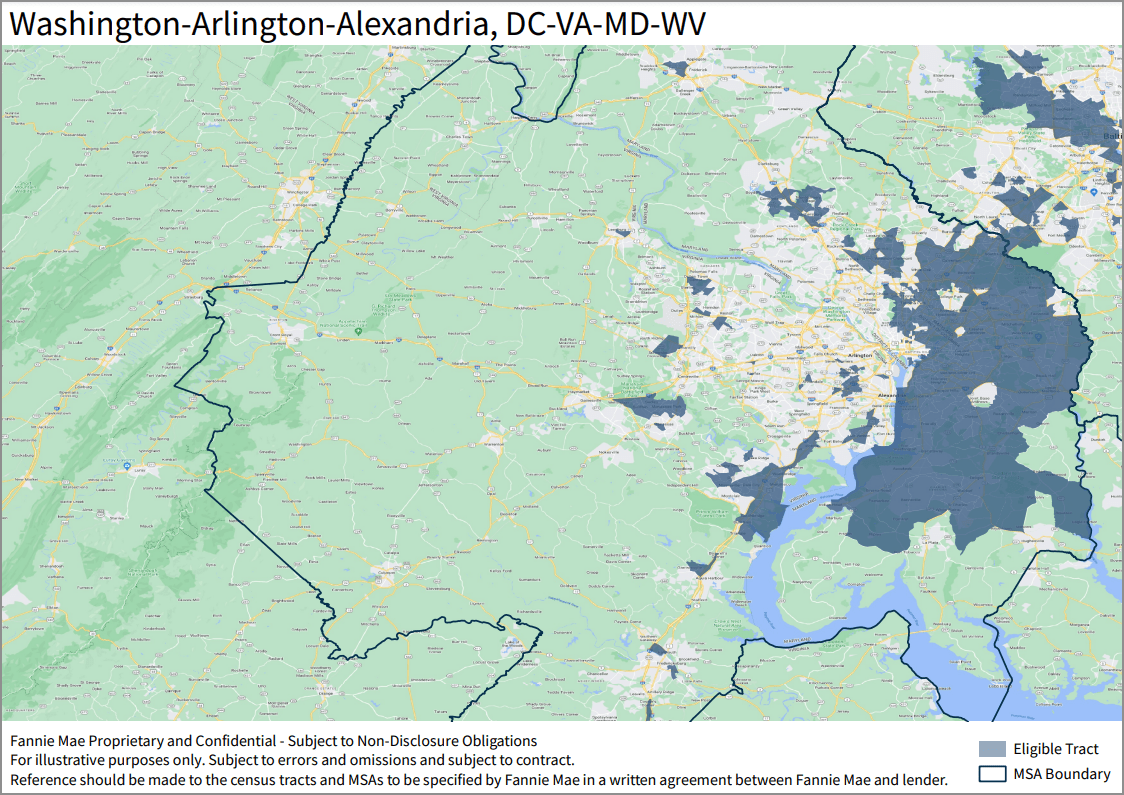

Millennial Home Loans, for a limited time only, is offering the Purchase Plus Conventional Loan program, which provides a $5,250 Down Payment Credit, based on a first-time homebuyer currently living within one of six designated metropolitan statistical areas. Minimum 3% down payment required. This means the effective down payment required on a 3% conventional loan can be reduced $5,250.

Purchase Plus Down Payment Credit Program offers the following benefits:

- $5,250 in lender credit that can be used toward a down payment and/or closing costs

- $500 appraisal credit applied at settlement

- Lower monthly mortgage insurance rates

- Unlike most Grant Programs, there is no second lien required, no grant repayment, no minimum time required to live in the house, no maximum household income requirements, no median borrower income requirements, and no settlement delays while the grant program provider reviews the grant request

- No geographic restrictions of where the homebuyer purchase their home

Purchase Plus Payment Credit Program Borrower Eligibility Requirements

- The homebuyer must currently live in an eligible censes tract with six metropolitan statistical areas

- Millennial Home Loans is licensed in Maryland, Pennsylvania, and Virginia and can assist homebuyers currently living in Baltimore-Columbia-Towson, Philadelphia, and throughout smaller communities in Maryland-Virginia

- Loan amount can’t exceed conforming loan limits

- Maximum loan to value of 97%

- Desktop Underwriting findings must be “Approved/Eligible”

- Minimum middle credit score of 620

- 3% to 6% maximum seller closing cost assist allowed, based on the down payment amount

- One the borrowers on the loan application must be a first-time homebuyer, which is defined as not having an ownership interest in a residential property in the three-year period prior to purchasing the new home

- Non-occupant co-client is allowed if the loan-to-value is less than or equal to 95% and can own other properties

- Occupant borrowers may not own any other financed property at the time of closing of the loan

- At least one borrower on the loan must complete an online first-time homebuyer course

- Manufactured homes permitted with 5% down payment

The borrower must CURRENTLY live in a designated area, which can be determined using the below Purchase Plus address verification tool

Below is a list of some of the included areas:

- ANNE ARUNDEL COUNTY: Annapolis Junction, Brooklyn Park, Fort Meade, Jessup

- BALTIMORE CITY: Large areas included

- BALTIMORE COUNTY: Curtis Bay, Guilford, Hebbville, Lochearn, Middle River, Middlesex, Milford Mill, Owings Mills, Randallstown, Rossville, Sparrows Point, Woodlawn

- HARFORD COUNTY: Aberdeen, Edgewood, Perryman, Wildwood

- HOWARD COUNTY: Columbia (very limited areas), Guilford, Jessup

Talk to a Purchase Plus Program Mortgage Expert

Not ready to apply online? No problem.

Answer a few questions, and a Purchase Plus Program Home Loan Mortgage Expert will call you back.

Today's Interest Rates

Interest rates change on a daily basis.

To receive a quick quote on current interest rates

to receive an update interest rate quote.